Securing investments means staying vigilant against scams using manipulated data and high-pressure tactics. Understanding defendants' rights in criminal cases – including fair trial protections and potential charge dismissal – empowers individuals to navigate legal complexities. Thorough research, skepticism of too-good-to-be-true offers, and trust in instincts are key to avoiding securities scams.

In the complex world of investments, securities scams pose a significant threat to investors. This article illuminates common schemes and red flags, empowering readers with knowledge to protect their assets. We delve into defendants’ rights in financial fraud cases, highlighting legal protections for those wronged. Additionally, discover practical strategies to avoid becoming a victim, ensuring you make informed decisions in the stock market. Stay vigilant, as understanding these tactics is your first line of defense against securities scams.

- Understanding Common Securities Scams and Red Flags

- Navigating Defendants' Rights in Financial Fraud Cases

- Protecting Yourself: Strategies to Avoid Falling Prey

Understanding Common Securities Scams and Red Flags

Understanding Common Securities Scams and Red Flags

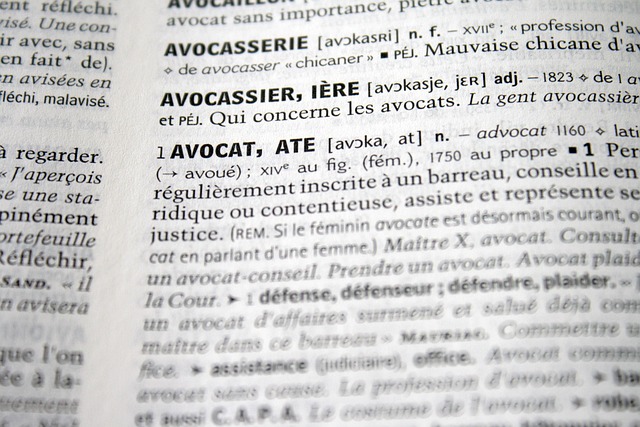

In the complex world of investments, securities scams are a significant concern for investors across all levels. To protect oneself, it’s crucial to recognize the red flags that often signal fraudulent activities. These scams can take various forms, from false promises of high returns with little or no risk to sophisticated schemes involving complex financial instruments. One common thread among these scams is the manipulation of market information and the exploitation of investor trust.

By understanding the tactics employed by defendants in criminal cases related to securities fraud, investors can better safeguard their rights throughout all stages of the investigative and enforcement process. An unprecedented track record of successful prosecutions highlights the importance of recognizing and reporting suspicious activities. Whether through misleading marketing materials, fake investment opportunities, or intricate Ponzi schemes, early detection is key. If you encounter any unusual offers or pressures to invest quickly, it might be a good idea to seek independent advice before making any decisions, ensuring your defendants’ rights in these critical situations.

Navigating Defendants' Rights in Financial Fraud Cases

In financial fraud cases, understanding defendants’ rights is paramount. Accused individuals face a complex web of legal procedures, and their rights vary significantly compared to those in regular criminal cases. For his clients, navigating this landscape can be daunting, but key protections exist. The right to counsel, ensuring a fair trial, and the possibility of a complete dismissal of all charges are fundamental aspects that defendants should know about.

During jury trials, defendants enjoy the right to present their defense openly, challenging the prosecution’s evidence. This balance ensures a thorough examination of facts, allowing for potential acquittals or reduced sentences. It is crucial for those accused to be aware of these rights, enabling them to actively participate in their legal process and mitigate potential outcomes.

Protecting Yourself: Strategies to Avoid Falling Prey

Securing your financial future is paramount, especially when navigating the complex world of investments. Protecting yourself from securities scams requires a multi-faceted approach. Firstly, always conduct thorough research on any investment opportunity that seems too good to be true—it likely is. Be wary of high-pressure sales tactics or promises of quick, substantial returns.

Educate yourself about the respective business and its track record. Verify the credentials and reputation of those offering investments. Understanding your defendants’ rights in criminal cases can also offer insights into potential scams, as some fraudulent schemes may involve legal repercussions. Avoiding indictment and jury trials should be a red flag, as legitimate businesses and investments rarely face such extreme legal outcomes. Trust your instincts; if something feels off, it’s best to steer clear.

In exposing securities scams, understanding common red flags and protecting oneself are key. While navigating defendants’ rights in financial fraud cases is crucial, awareness and proactive measures can significantly reduce the risk of falling prey. By familiarizing yourself with these strategies and staying vigilant, you can better safeguard your investments and contribute to a more transparent financial landscape, ensuring your interests are protected in the event of criminal proceedings regarding financial fraud.